Nov 11, 2024

Imagine opening your monthly budget and feeling complete peace about your giving decisions. For many Christians, this sense of confidence seems out of reach—especially when it comes to tithing. Did you know that only 13% of Christians tithe regularly, yet those who do often report greater financial peace and spiritual fulfillment? Whether you're new to tithing or looking to make it a more consistent practice, this guide will help you develop a sustainable giving habit that honors both your faith and your financial wellness.

In today's world, many believers struggle to balance their desire to give with the need for financial stability. The good news? You don’t have to choose between faithful giving and financial wisdom. This guide will show you how to make tithing a transformative spiritual practice that enhances your financial well-being.

Understanding Biblical Principles of Tithing

The word "tithe" literally means "tenth," originating from the practice of giving one-tenth of one’s income to support religious institutions. While simple in definition, biblical teachings on giving go far beyond numbers.

Key Biblical Insights:

Malachi 3:10: “Bring the whole tithe into the storehouse... Test me in this...”

Trust in God’s provision

Support ministry work

Experience blessings through obedience

2 Corinthians 9:7: “God loves a cheerful giver.”

Focus on the heart attitude behind giving.

View tithing as worship and gratitude.

Modern Application:

Develop a generous heart beyond legalism.

See tithing as a starting point, not a limit.

Recognize all resources as God’s provision.

Financial Wellness Foundations for Consistent Tithing

A strong financial foundation makes tithing sustainable.

How to Build a Tithing-Focused Budget:

Calculate your gross income.

Set aside your tithe first—before expenses.

Build your remaining budget around your giving commitment.

Adjust monthly as needed.

Emergency Fund Strategy:

Quick-save $1,000 for immediate needs.

Gradually build to 3-6 months of expenses.

Keep the fund separate to avoid temptation.

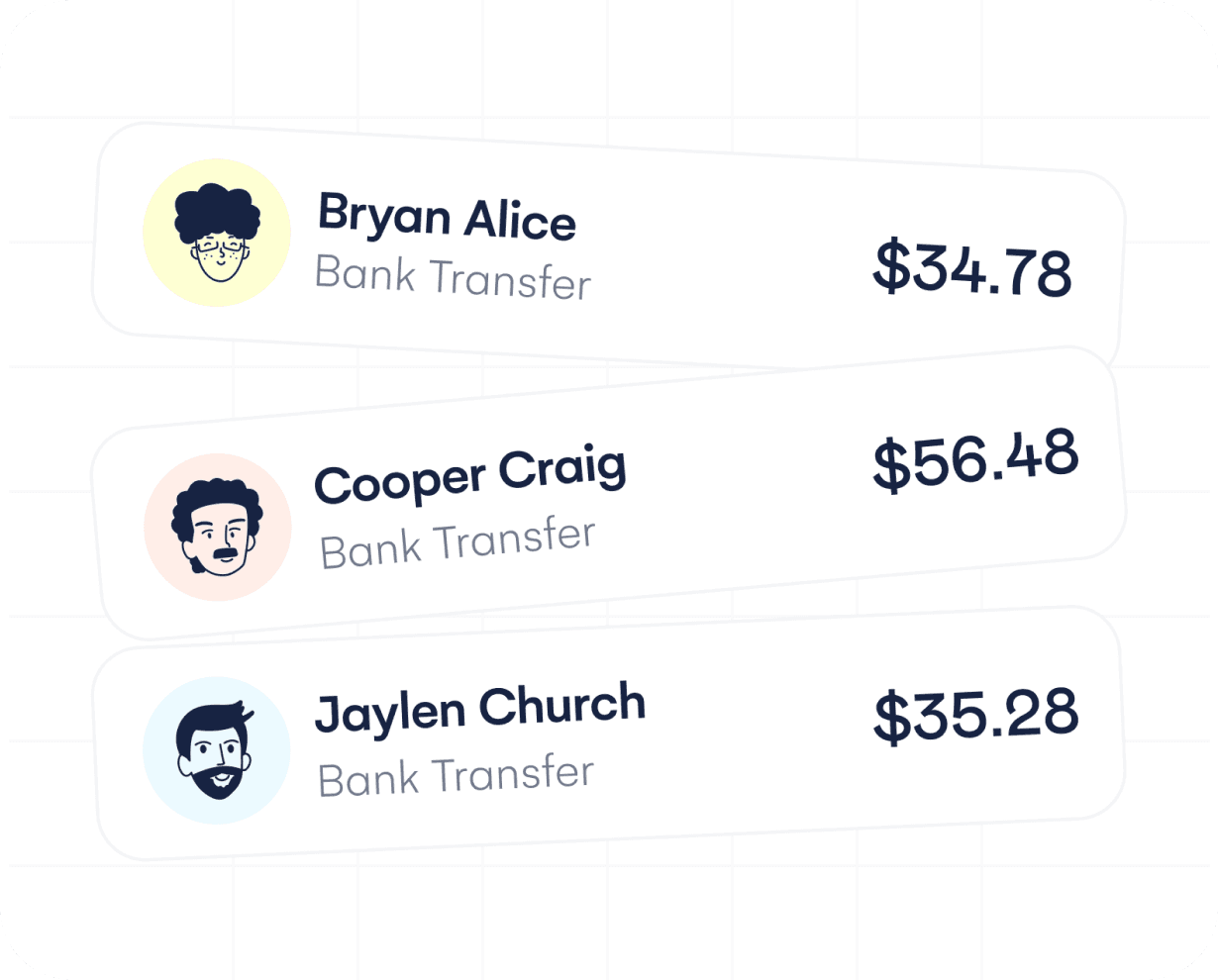

Modern Tools for Digital Giving:

Church-specific apps.

Recurring bank transfers.

Online platforms with envelope budgeting systems.

Practical Steps to Develop a Tithing Habit

Consistency requires intentional actions and practice.

Step-by-Step Guide:

Start Small:

Begin with a percentage you can sustain.

Gradually increase as you grow in faith and finances.

Automate Giving:

Set up recurring transfers on payday.

Use bank bill-pay or giving apps.

Adjust Your Lifestyle:

Reduce discretionary spending.

Redirect savings toward giving.

Track Progress:

Monitor your giving history.

Celebrate milestones.

Document spiritual growth.

Overcoming Common Tithing Challenges

Even with the best intentions, obstacles arise. Here’s how to address them:

Irregular Income:

Calculate giving as a percentage, not a fixed amount.

Create a buffer fund during higher-income months.

Financial Emergencies:

Maintain a robust emergency fund.

Develop multiple income streams.

Balancing Debt and Tithing:

Use debt repayment strategies like the snowball or avalanche methods.

Stay committed to giving while reducing debt.

Family Conversations:

Discuss giving priorities openly.

Set shared financial goals.

Teaching Children About Tithing and Stewardship

Passing healthy giving habits to the next generation is crucial.

Age-Appropriate Tips:

Ages 3-5: Use jars for saving, spending, and giving.

Ages 6-12: Teach percentage-based giving and budgeting.

Teenagers: Discuss biblical money principles and encourage personal giving choices.

The Impact of Consistent Tithing

Regular tithing creates profound spiritual and financial effects.

Personal Growth:

Deepened trust in God.

Improved financial discipline.

Strengthened faith.

Community Impact:

Funded local ministry initiatives.

Enabled outreach programs.

Legacy Building:

Established family giving traditions.

Inspired future generations.

Conclusion

Making tithing a habit isn’t just about financial discipline—it’s about growing in faith and trust. Start today by choosing one actionable step:

Set up automated giving.

Create a tithing-focused budget.

Hold a family meeting about giving priorities.

Remember: The goal isn’t perfection but progress. Begin where you are, trust God’s guidance, and watch how consistent giving transforms your spiritual and financial life.

What will your first step be? Share your commitment with a trusted mentor and start making tithing a meaningful part of your journey today!